foreign gift tax return

What Are the General Requirements to Report Foreign Gifts. Persons who receive gifts from a non-resident alien or foreign estate totalling more than 100000 in a tax year or a gift of more than 16388 in 2020 from foreign corporations or foreign partnerships 5.

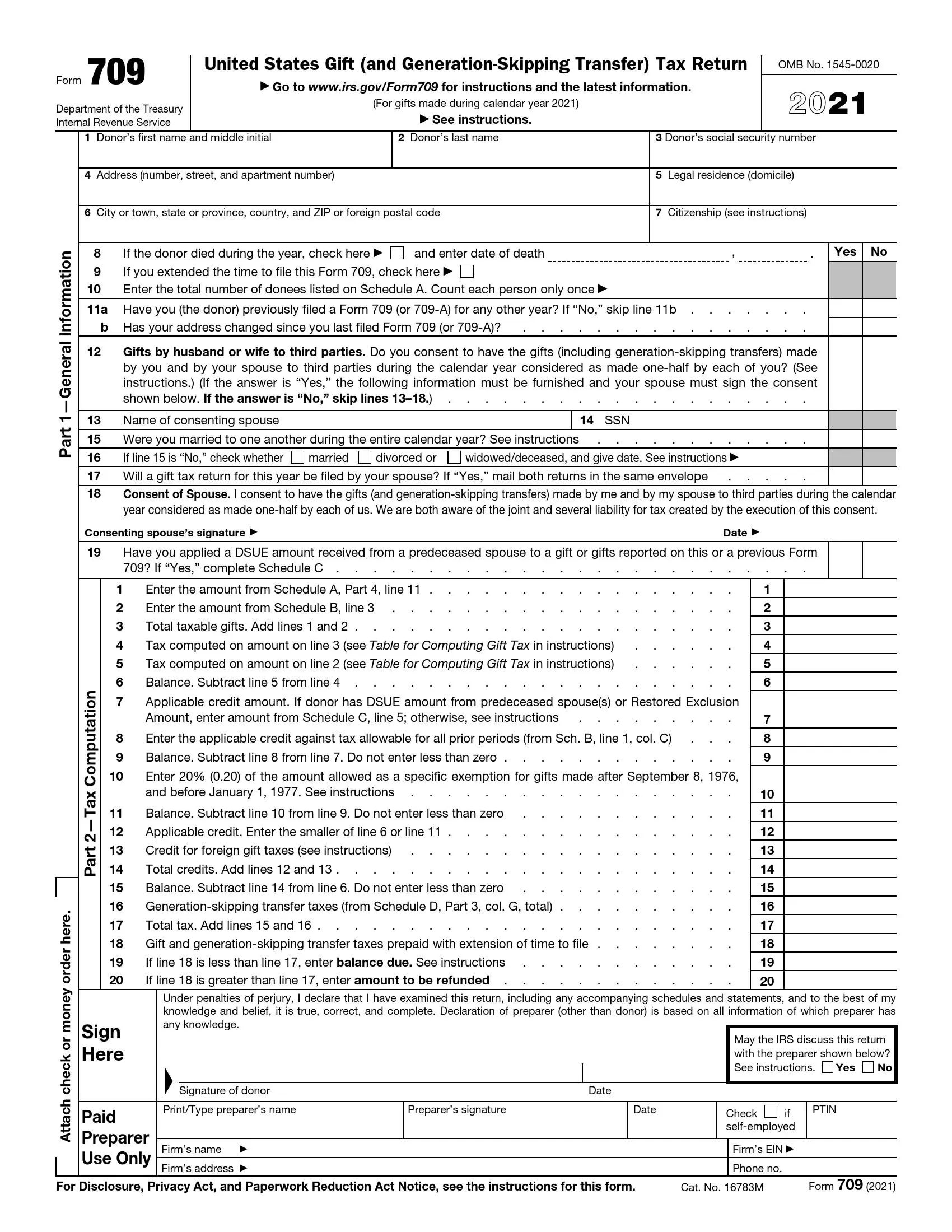

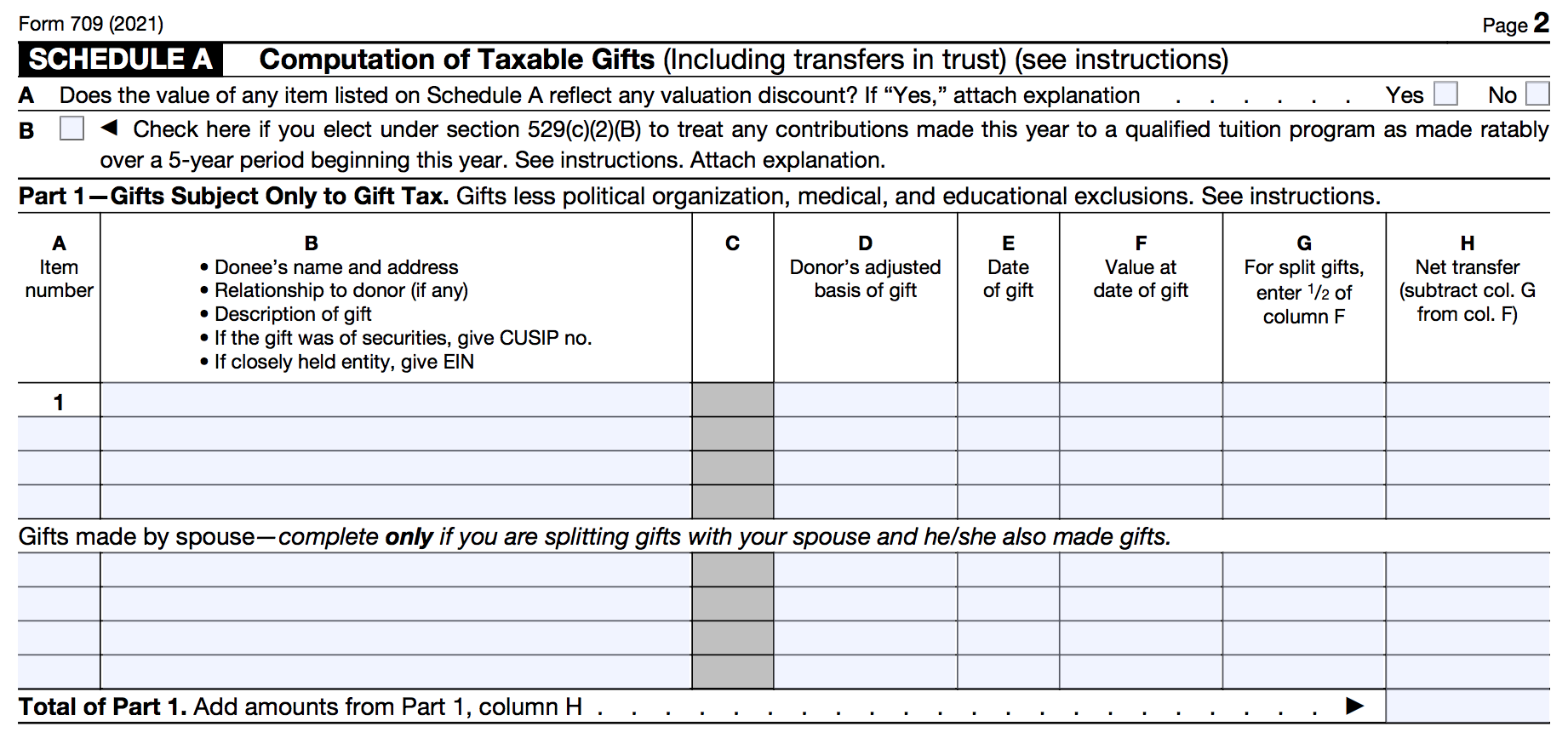

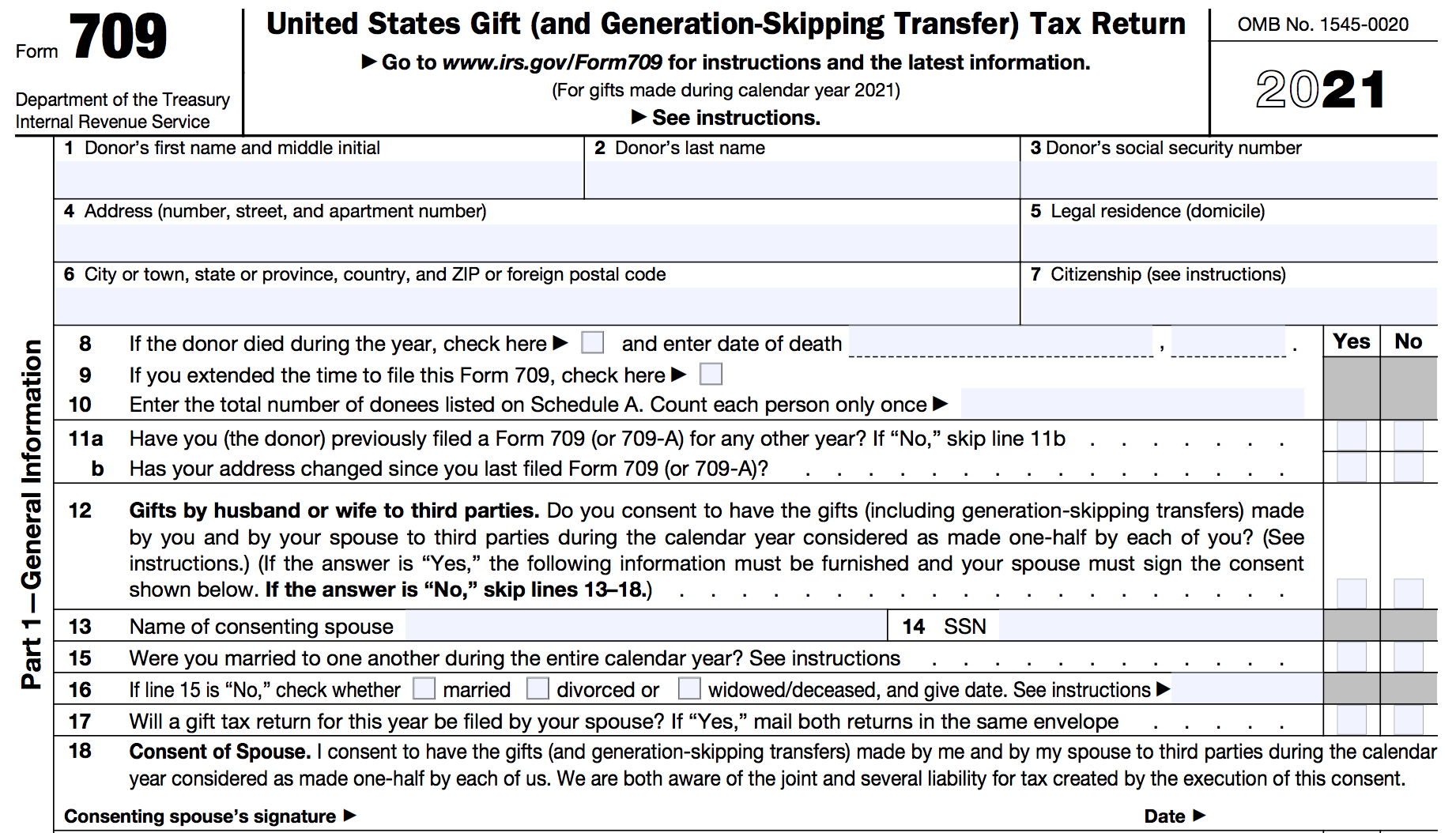

Irs Form 709 Fill Out Printable Pdf Forms Online

Check the box if you are married and filing a current year joint income tax return and you are filing a joint Form 3520 with your spouse.

. Foreign Gift Tax the IRS. Form 3520 is due the fourth month following the end of the persons tax year typically April 15. You have to report the sale of the land in the.

Person receives a gift from a foreign person the IRS may require the US. A gift tax return is a tax form that needs to be filed by the donor of the gift if they make a transaction of the gift of value exceeding the prescribed limit known as gift tax exemption. For gifting purposes there are three key categories of US.

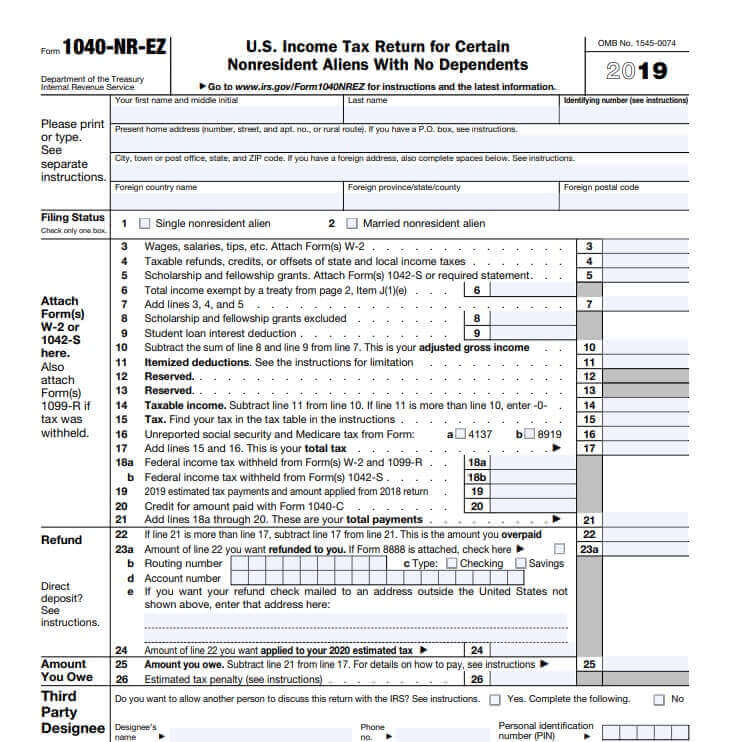

The threshold requirement for reporting is much lower and in 2019 it was 16388. Foreign Entity and Form 3520 Filing When a person receives a gift from a foreign entity the rules are different. For a nonresident not a citizen of the United States the gift tax applies to the transfer by gift of certain US-situated property.

In addition gifts from foreign corporations or partnerships are subject to a. Regardless the IRS is aggressively enforcing compliance with foreign gift reporting. Person must report the gift when the threshold is met on IRS form 3520.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Form 3520 is an informational return similar to a W-2 or 1099 form rather than an actual tax return because foreign gifts themselves are not subject to income tax unless they produce income. Persons who receive gifts or bequests from foreign persons bewarethese gifts or bequests may need to be reported to the Internal Revenue Service IRS.

In this case you write both names in box 1a your TIN in box 1b and your spouses TIN in box 1d. Persons tax return check this box and attach statement. Person receives a gift from a foreign person.

Upon receipt and verification including matching current taxpayer and taxpayer representative records a copy of the original tax return or the account transcript will be mailed. According to the IRS if you are a nonresident alien who made a gift subject to the foreign gift tax you must file a gift tax return Form 709 if. If you inherited land worth 100000 or more from a foreign person you have to report it by filing Form 3520.

You would therefore file it separately from your Form 1040 tax return. If an extension was requested for the tax return check this box. The consequences for failing to do so can be costly.

Persons who must file this form. There are certain filing threshold requirements that the gift s must meet before the US. If an automatic 2-month extension applies for the US.

If you receive over 100000 in inheritance then you must declare the amount on Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Persons may not be aware of their requirement to file a Form 3520 because they have no income or have no tax return filing requirements. That is because the foreign person non-resident is not subject to US.

Form 3520 is not a Tax Form. Person to file a form 3520 to report the gift. What about if it is a gift.

And check box 1i. Person must r eport the Gift on Form 3520. As a result the person giving the gift files a gift tax return.

Who Reports Gifts from Foreign Persons to the IRS. You gave any gifts of future interests Your gifts of present interests to any donee other than your spouse total more than 13000 or Your outright. Important Practice Tip If you receive a gift from Taiwan for Example of 600000 and your Dad needed 12 of their friends to each facilitate the transfer of 50000 due to currency restrictions this is still reportable.

The irs states in the opening paragraph in this publication that if you are a us. In other words if a US. If you are the sole beneficiary then you file the 3520 in your name only.

March 2 2021 824 AM. It will not be taxed it is simply a declaration. Therefore if a US person received a gift from a foreign entity that exceeds 16815 then form 3520 is required.

IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate. Form 3520 is used to report the existence of a gift trust or inheritance received from foreign persons. Inheritance taxes are only deductible on an estate tax return so that would not apply.

There is no specific IRS taxes on gifts received from a foreign person. This value is adjusted annually for inflation. 512 672 8920 Foreign Gifts and IRS Reporting US.

Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. The receipt of the land is not taxable. The receipt of cash as a gift or inheritance is not taxable.

Person to file a Form 3520 to report the transactions. The rules are different when the US. Person receives a gift from a foreign person that specific transaction is not taxable.

If both you and your spouse are beneficiaries of the gift then you both should file a joint form 3520. File Form 3520 each year you receive a foreign gift separately from your income tax return by following the directions in the Instructions to Form 3520. Thus the donor of the gift shall file the gift tax return unless otherwise required by the law.

Has no tax authority over the foreign person. The tax applies whether or not the donor intends the transfer to be a gift. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and payment.

Ensure that you do this as the penalties can be quite significant. Person receives a gift from a foreign person that meets the threshold for filing the US. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.

Therefore the IRS requires the recipient US. Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion applies. Persons who receive a distribution.

The form for a gift tax return is IRS Form 709. Person has to report the foreign gift. Person other than an organization described in section 501 c and exempt from tax under section 501 a who received large gifts or bequests from a foreign person you may need to complete part iv of form 3520 annual return to report transactions with foreign.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Us Tax For Nonresidents Explained What You Need To Know

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Gifts From Foreign Persons New Irs Requirements 2022

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Gifts From Foreign Persons New Irs Requirements 2022

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

How To Fill Out A Fafsa Without A Tax Return H R Block

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

Complying With New Schedules K 2 And K 3

Gifting Money To Family Members Everything You Need To Know

Us Tax For Nonresidents Explained What You Need To Know

Timely Filing The Feie Form 2555 Expat Tax Professionals

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service